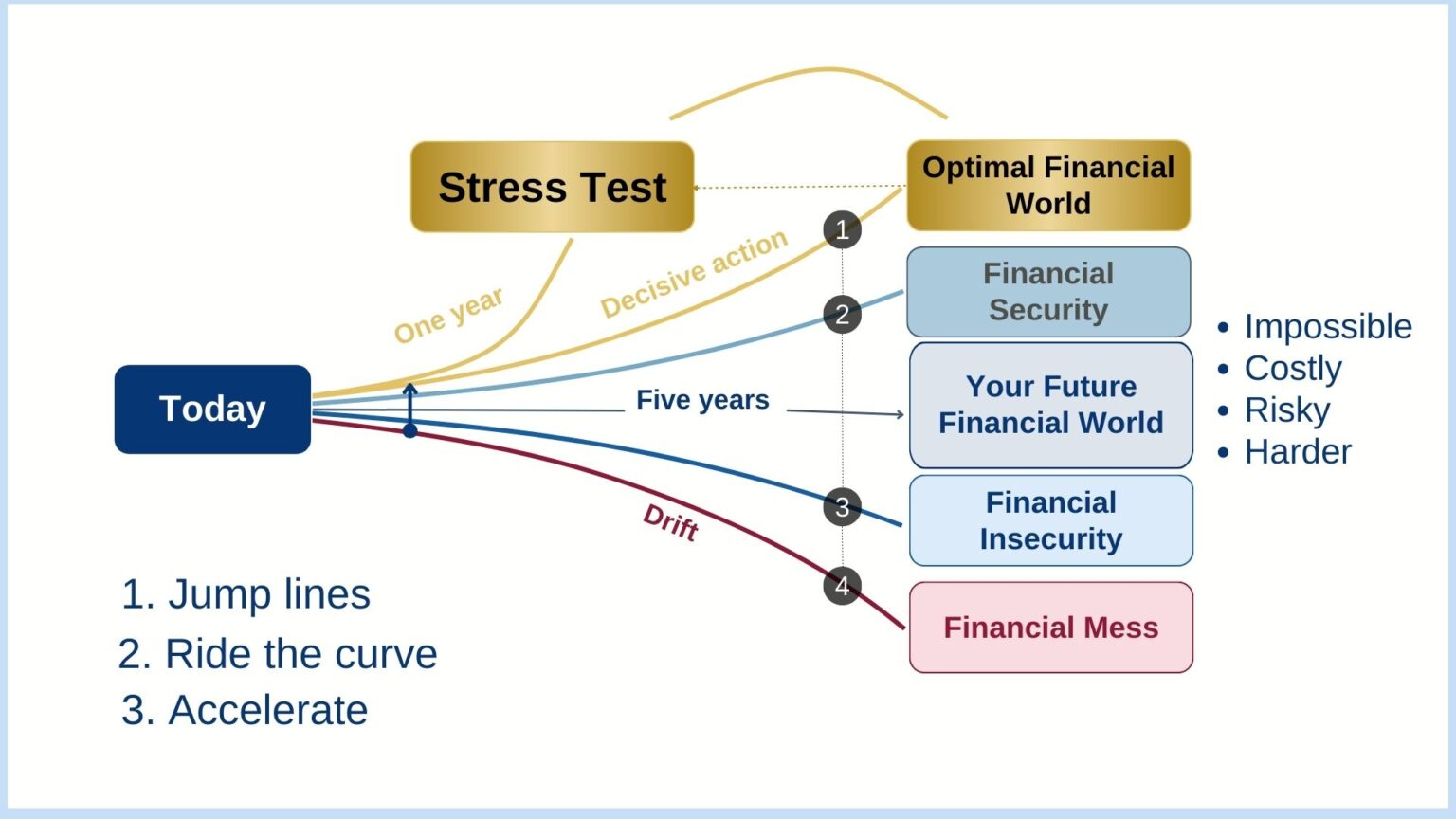

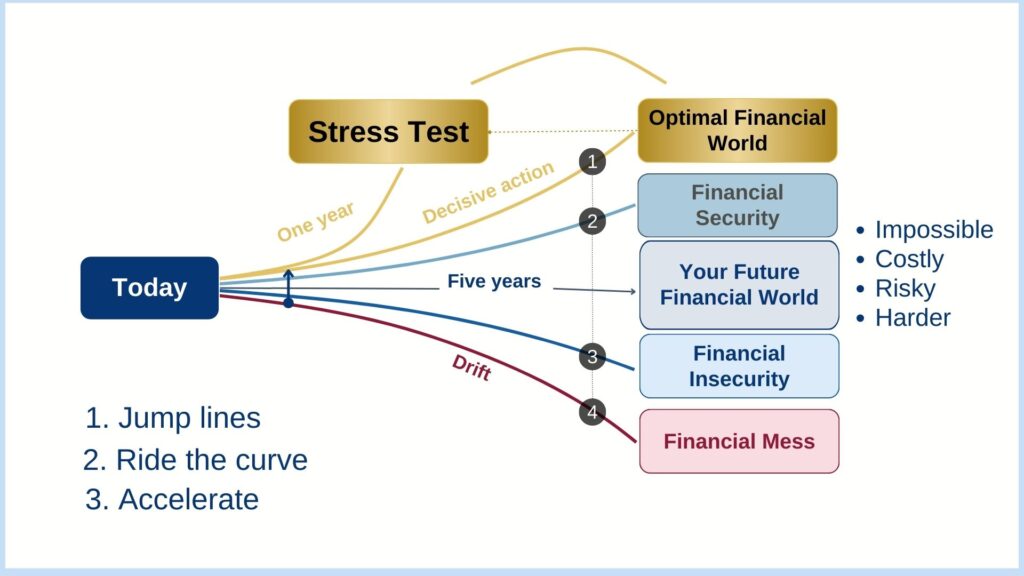

Stress Test

Start Your Journey With a Stress Test of Your Wealth Plan

The best way to begin working with our virtual family office is with a stress test. Stress testing systematically evaluates whether the financial strategies you are using will deliver the results you expect. It also helps ensure that you are not missing any meaningful opportunities that could add significant value to your family’s financial life.

Stress testing is not about being sold services or products, nor will it always result in making any changes to your current wealth plan. It is about helping ensure that you are employing the best solutions for your unique situation

Why A Stress Test?

Just like getting an annual physical, we want to Stress Test the Five Major Areas of Concerns to make sure we are good and sound. We want to make sure to avoid any potentially destructive situations and to ensure to benefit from all the possible opportunities.

The 5 Key Areas of Concerns to be Stress Tested

1. Wealth Preservation

Preserving Personal Wealth by Making Smart Decisions About Money

2. Wealth Enhancement

Mitigating Taxes For The Present and In The Future

3. Wealth Transfer

Transferring Assets To Loved Ones In The Right Way

4. Wealth Protection

Protecting Assets From Being Unjustly Taken

5. Charitable Giving

Magnifying Your Charitable Impact to The Causes You Believe In and Not To The Government

There are Three Steps in the Stress-Testing Process:

1. Discovery

To be successful, the professional leading your stress test needs to gain a deep understanding of you and your family—including your goals, values and concerns, not just your assets. That’s why stress testing begins with a discovery meeting—an in depth conversation that explores key areas of your life and the actions you are currently taking to achieve all that is most important to you.

2. Evaluation

Following the discovery meeting, we may ask you for some documentation, such as tax returns or insurance policies, depending on the focus of the stress test. We will then coordinate with the experts of our virtual family office to evaluate your current strategies, including their assumptions, costs and alignment with your goals.

3. Recommendations:

Finally, we will offer recommendations, which could include staying the course, considering different solutions or modifying your current approach.