Virtual Family Office

Welcome To Your Virtual Family Office

Virtual family office (VFO)—a groundbreaking approach to managing your wealth and optimizing your financial world. We have partnered with carefully selected, top-tier wealth managers, accountants and attorneys to offer a service that covers all aspects of wealth and lifestyle management.

What Is A Virtual Family Office?

A virtual family office brings the traditional family office historically reserved for only the most affluent—to a wider audience. Thanks to advances in technology and

wealth management, we’re now able to offer these sophisticated, comprehensive solutions to successful families like yours.

You've Worked Hard For Your Success

But it’s likely you want to do more than just grow and protect your wealth; you also want to take extraordinary care of your loved ones, contribute to your community, maybe even make a substantial difference in the world.

To turn these aspirations into reality, you may need something more than your current financial and legal guidance. You need to optimize your financial world. What exactly does this mean?

In your optimal financial world, your goals are precisely defined, you have a clear process for achieving them, and you have access to the experts and strategies to

succeed.

The Power of Collaborative Wealth Management.

Our VFO’s collaborative methodology helps ensure a holistic approach to your wealth management. This synergy enables:

Deep, integrated expertise: By uniting experts from various fields, we offer a rounded, more informed strategy that covers every facet of your financial life.

Adaptable, forward-thinking strategies: As your life evolves, so do our strategies. We regularly monitor your wealth plan to see that it remains robust, flexible and future-proof.

Efficient management: Our integrated team approach streamlines your wealth management, simplifying complex financial decisions and smoothing your financial journey.

A personalized, trust-based relationship: Beyond managing assets, we forge deep, lasting relationships with our clients. Our commitment to open, consistent communication sets the foundation for a partnership defined by trust and mutual success.

How you can benefit from our Virtual Family Office?

Integrated wealth management solutions. We address a broad range of key issues, from investments and estate planning to tax strategy, asset protection and charitable planning. Each expert on our team brings their specialized skills and knowledge to bear on your financial strategy.

Customized support services. We understand that wealth management is about more than just numbers. That’s why through VFO, we offer a wide array of support services tailored to the unique needs of our clients. From creating family governance, writing your family constitution, tax compliance to family security and finding bespoke healthcare.

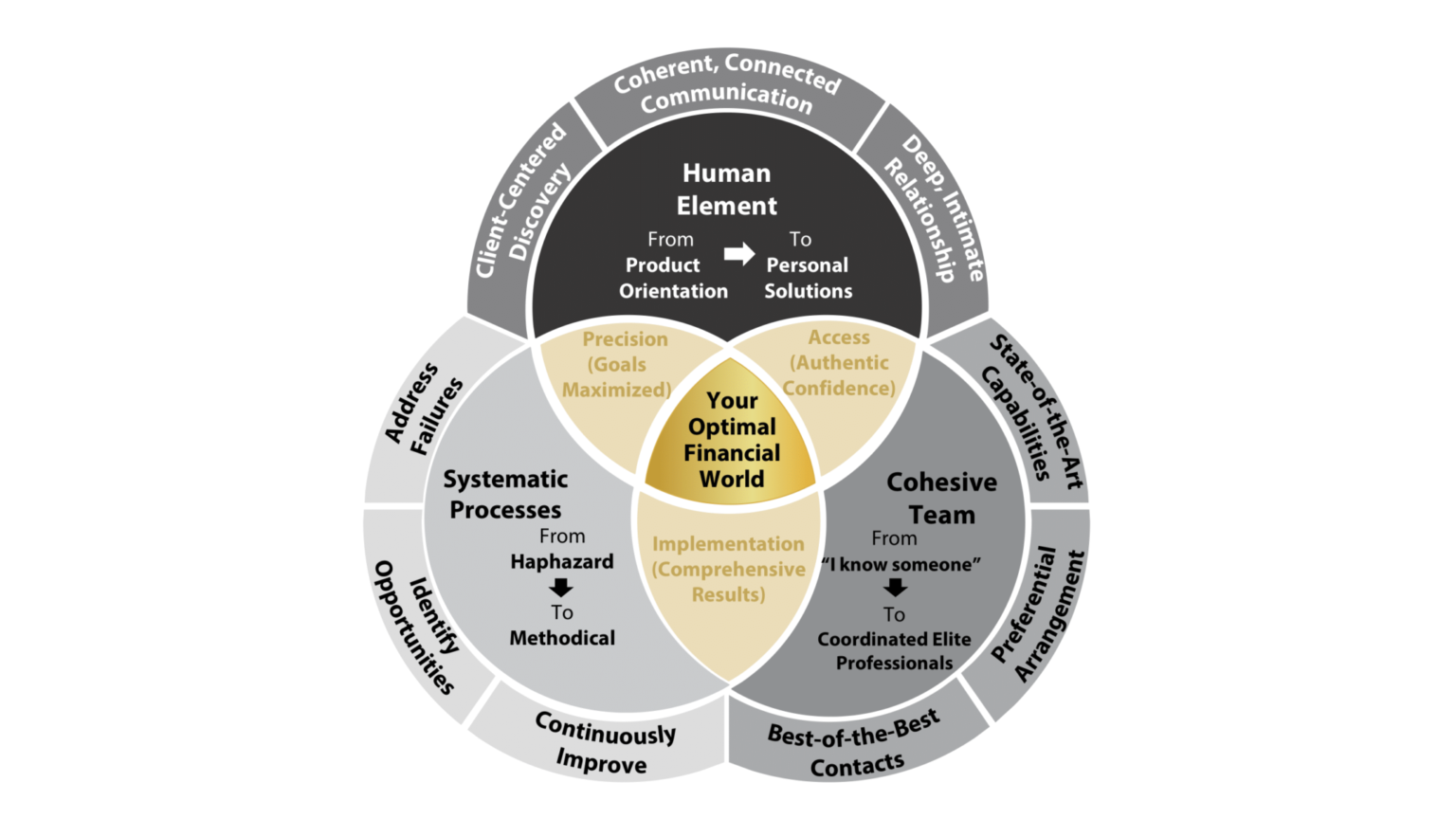

Our VFO Framework

Our VFO Framework

Our VFO Process

1. Exploratory Call

An Opportunity for us to Get to Know Each Other Better

2. Discovery Meeting

Gaining Insight into Your Values, Goals, and Priorities

3. Initial Findings Meeting

Presentation of Preliminary Wealth Assessments and Engagement to Move Forward

4. Mutual Commitment Meeting

Presentation of Investment Plan and Review of Account Transfer Process

5. Implementation Meeting

Comprehensive Evaluation of the Five Key Areas of Concerns and Stress Testing. Recommendations for Moving Forward

6. Regular Progress Meeting

Review Progress and Implementation of Advanced Plan